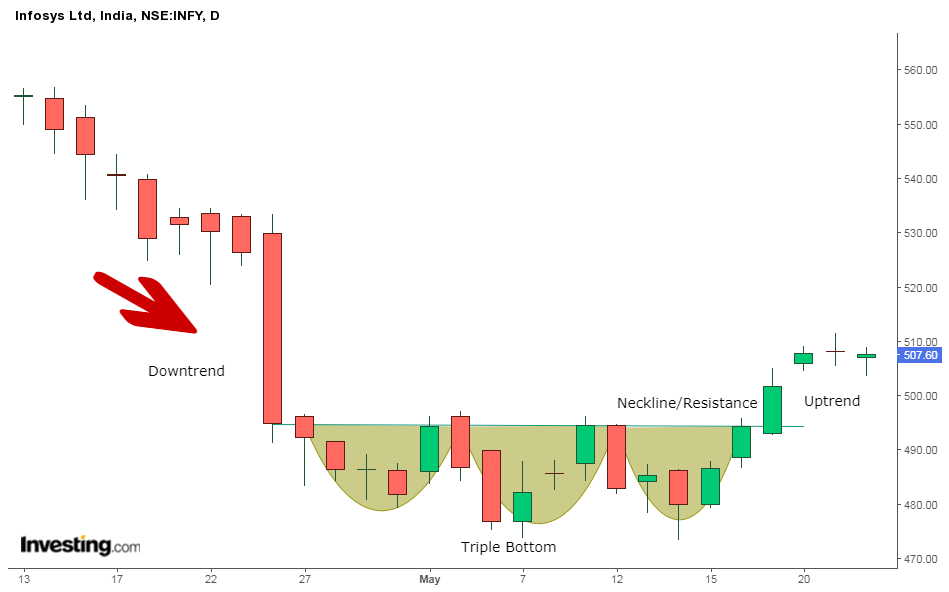

A triple bottom breakdown that forms as a consolidation after a decline would be viewed as a continuation pattern. This means implications there have been three failed attempts at making new lows in the same area, followed by a price move up through resistance.

Tutorials On Triple Bottom Chart Pattern

Distinguishing between reversal and continuation depends on the prior move.

/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)

Triple bottom stocks meaning. There are three equal lows followed by a break above resistance. Triple top pattern and triple bottom bottom for stocks, forex and crypto. A battle between demand and supply.

It’s created when price bounces off support 3 time at similar levels. A triple bottom is generally seen as three roughly equal lows bouncing off support followed by the price action breaching resistance. By understanding the trends, a trader can confirm an.

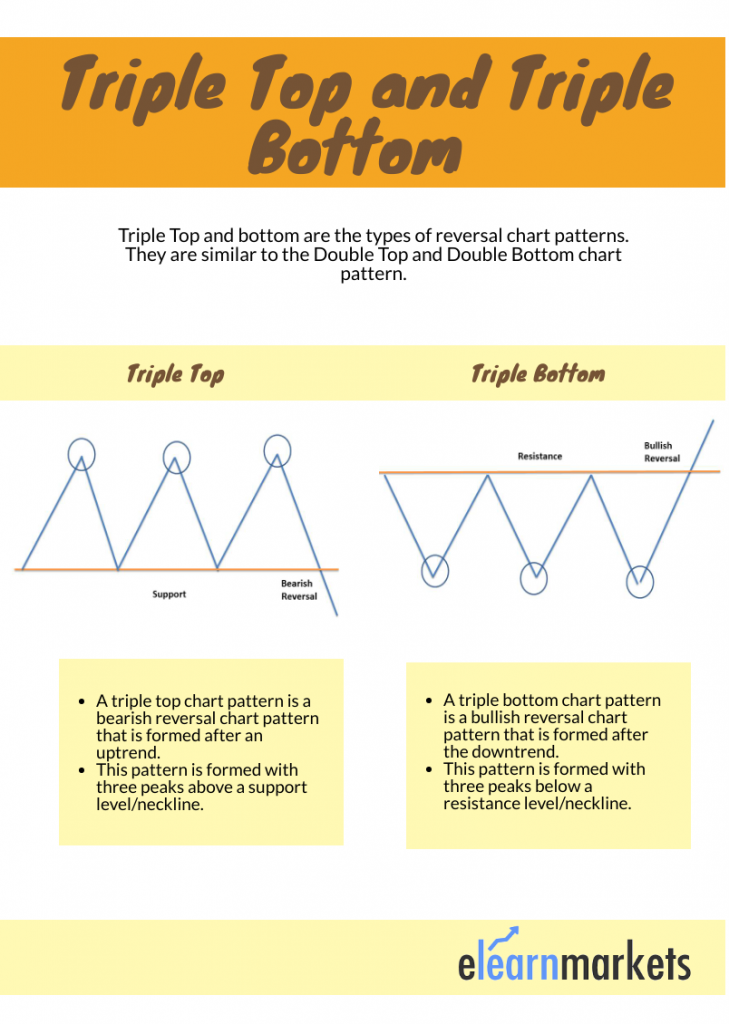

But for the pattern to be termed as a triple top, it has to be found after an uptrend. It shows that the price of an asset is no more falling and could get higher. Although stock trading has developed in the western market, many indians still consider it gambling.

The pattern can be found on bar charts, line charts and candlestick patterns with a distinct bounce off a support level three times. However, the reality is quite different. What is the triple bottom line?

The triple bottom pattern occurs as a part of the accumulation phase of the market cycle, but more specifically, it visually represents the battle between demand and supply — buyers and sellers. Triple top and triple bottom are reversal chart patterns used in the technical analysis of stocks, commodities, currencies, and other assets. The triple bottom reversal is a bullish reversal pattern typically found on bar charts, line charts and candlestick charts.

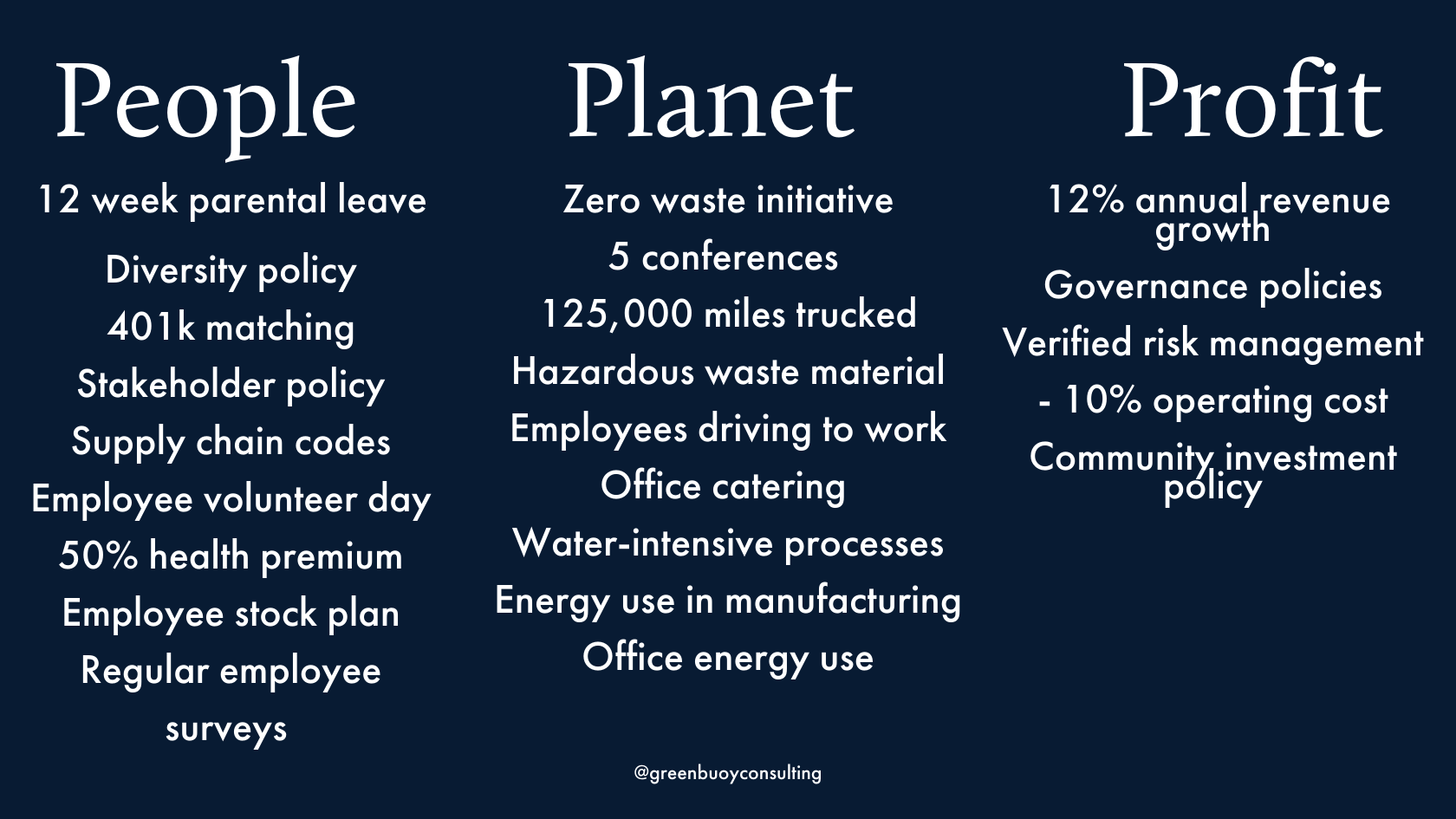

Now, the term triple bottom line defines the profitability of. So, we will discuss the significance of the pattern under the following: The triple bottom is the opposite of a triple top.

The triple bottom pattern a bullish reversal pattern used to predict the bottoming of stock that has been in a downtrend. Zoom out and look at the daily, hourly, and other time frames before you enter that trade on the 5. Made up of three peaks, a triple top indicates that the asset may no longer be coming up.

This pattern also signifies that lower prices may be on the horizon. The bottom line has always been a reference to financial statements ending with a. However, the opposite of a triple is a triple bottom, which indicates the asset's price is no longer falling and could head higher.

A “rally” pertains to a period of sustained increases in the prices of stocks. As i explained above, the bottom line is derived from a company’s net income and is used to display its financial performance and enhance it in some cases. The triple bottom line defined the tbl is an accounting framework that incorporates three dimensions of performance:

Tools within the triple bottom line help to measure, benchmark, set goals, improve, and eventually evolve toward more sustainable systems and models. You can find them on any type of chart with a candlestick. The triple bottom stock pattern is a chart pattern used in technical analysis that’s identified by three equal lows followed by a breakout above the resistance level.

This chart pattern can be present on all time frames. Triple bottom patterns can resemble other patterns as it’s developing. It’s a sign the buyers are coming in the market to.

A triple bottom is a reversal pattern with bullish implications composed of three failed attempts at making new lows in the same area, followed by a price move up through resistance. Accumulation phase of the market cycle. Traders who use technical analysis study chart patterns to analyze stocks or indexes price action in accordance with the shape chart creates.

This pattern is rare, but a very reliable buy signal. This differs from traditional reporting frameworks as it includes ecological (or environmental) and social measures that can be difficult to assign appropriate means of measurement. The triple bottom line is a transformation framework for businesses and other organizations to help them move toward a regenerative and more sustainable future.

Hence the importance of being able to see patterns within patterns. A triple bottom breakdown that forms as a top after an advance would be deemed a reversal pattern. This approach suggests that there should not be one but three bottom lines that a company adheres to.

The formation of triple bottom is seen as an opportunity to. Lower prices may be on the way. Here are some quick triple bottom line facts:

The triple bottom pattern is a bullish reversal pattern. Stock trading is often viewed as a game of chance. It is an economic concept that includes three aspects in its functioning:

Key takeaways a triple top. Triple bottom stocks, crypto, forex or futures. A triple top stock pattern signals that the stock has stopped rallying.

Triple bottom line is an accounting approach that focuses on creating a sustainable method of execution for corporates. The triple bottom stock pattern is a reversal pattern made up of three equal lows followed by a breakout above resistance. The triple bottom line (tbl) is a business and accounting framework that believes companies should care about social and environmental concerns just as they do their profits.

The Triple Bottom Candlestick Pattern Thinkmarkets En

The Complete Guide To Triple Top Chart Pattern

Triple Bottom Triple Bottom Pattern

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-01-4e2b46a5ae584c4d952333d64508e2fa.jpg)

Technical Analysis Triple Tops And Bottoms

How You Can Implement The Triple Bottom Line

The Triple Bottom Candlestick Pattern Thinkmarkets En

Triple Top Pattern Explained Stock Chart Patterns

Trading Tips With Triple Top And Triple Bottom Chart Patterns Httpwwwforexabodecomforex-schoolwatch-out-for- Trading Charts Stock Market Forex Trading

The Complete Guide To Triple Top Chart Pattern

Triple Bottom Reversal Chartschool

The Triple Bottom Candlestick Pattern Thinkmarkets En

Bearish Bullish Reversals Bdo Unibank Inc

/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)

Triple Top Definition

Triple Bottom Pattern And Triple Top- The Ultimate Guide

The Complete Guide To Triple Top Chart Pattern

Triple Bottom Pattern And Triple Top- The Ultimate Guide

Tutorials On Triple Bottom Chart Pattern

Triple Bottom Pattern And Triple Top- The Ultimate Guide

Triple Bottom Reversal Chartschool

Comments

Post a Comment