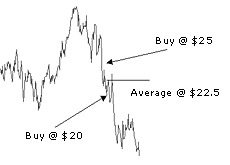

Stocks under $1 $2 $5 $10. Averaging down is an investing strategy that involves a stock owner purchasing additional shares of a previously initiated investment after the price has dropped.

Stock Average Calculator Average Down Calculator

New average price = [4.9031 + 4.5131] / 2 = 4.7081

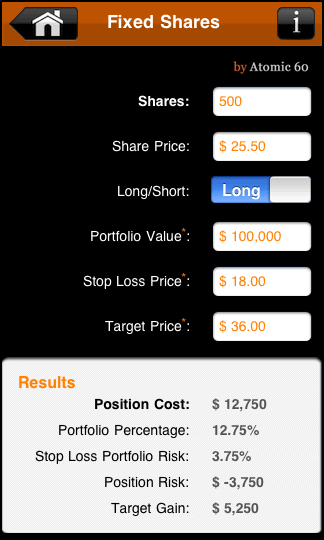

How to average down stock price. Simply input the number of shares of each buy and the purchase price of the stock to get the average share price. Download average down calculator as an excel file for free. How to calculate the stock by using average price in excel (2018) watch later.

Let’s assume that $10,000 is split equally among four purchases at. You can average down the price of your stock if you buy more shares when the price has fallen. This average down calculator will give you the average price for both average down and average up.

Which is the average price of the new stocks i bought. Divide this figure by the number of shares bought and you get 4.5131 pesos; Averaging down is an investment strategy that involves buying more of a stock after its price declines, which lowers its average cost.

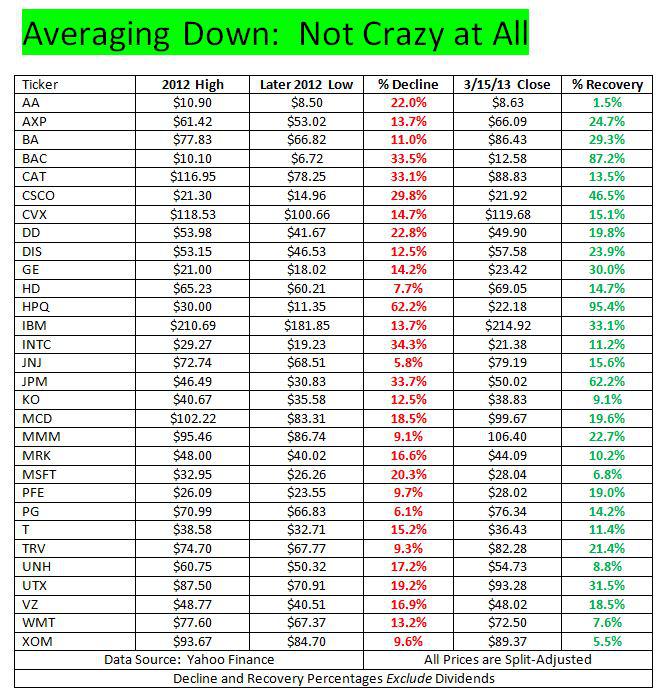

Each new purchase costs less, so the average cost declines. An investor who adopts an averaging down strategy might justify this decision by viewing a stock that has declined in price as being available at a discount to its intrinsic or fundamental value. You can get the price history from investing dot com.

Stock trading or investing is easy to get in, but it takes a lot effort to make money from the stock market. Now applying the formula above; The cheapest stocks—known as penny stocks—also tend to be the riskiest.

A slight upward move on share price can generate a better profit than just holding the stocks for price rise. What is averaging down a stock? If the stock fell to $10, and you bought another 100 shares, your average price per share would be $15.

Estimate p/e of future (p/e after 3 years from today) #1a. In a nutshell, averaging down means adding to a losing stock position in order to reduce your average share price. One investing approach that all traders ought to think over is averaging down. this means buying a stock, watching it drop and then buying more shares, resulting in a.

Let's stick with your original 100 shares of stock with a cost basis of $2,500. Averaging down the stock is done by purchasing more shares at a lower price than the previous price, which provides lower costs per share if the process is repeated. Averaging down is the opposite:

A stock that has dropped from $40 to $4 may well end up at $0, while a stock that goes. If you are an investor then this tool can be used to calculate the average share price of a stock that you purchased multiple times. Stock average calculator to calculate the average stock price of your stocks.

You would be decreasing the price. Let's say you buy 100 shares at $60 per share, but the stock drops to $30 per share. The answer is to do some averaging, if the old average price is much higher than the new average price then it is a good buy since you are averaging down your stock price.

If you buy a stock multiple times and want to calculate the average price that you paid for the stock, the average down calculator will do just that. Below is a pse calculator that i've created to save you the trouble of manually calculating the amount. Stock average calculator calculates the average cost of your stocks when you purchase the same stock multiple times.

If you purchase the same stock multiple times, enter each transaction separately. Averaging down can be an effecive stock market investing strategy when you believe the price will move higher. Calculate your roi by using the stock profit/loss calculator to determine your percentage rate of return.

You then buy another 100 shares at $30 per share, which lowers your average price to $45 per share. But before that, let’s know how to predict future price of stocks. Others choose to buy in thirds or some other fraction.

First note down monthly price of stock posted in last 3 years. Average down calculator will give you the average cost for average down or average up. Average down calculator simply enter your share purchase price above and the number of shares for each buy to get your average share price.

Investors buy on declines when they are convinced that a stock will recover to. If you then bought an additional 100 shares of stock at $9.95 per share plus a $5 commission, your total cost for all your shares would be $2,500 plus $1,000, or $3,500.

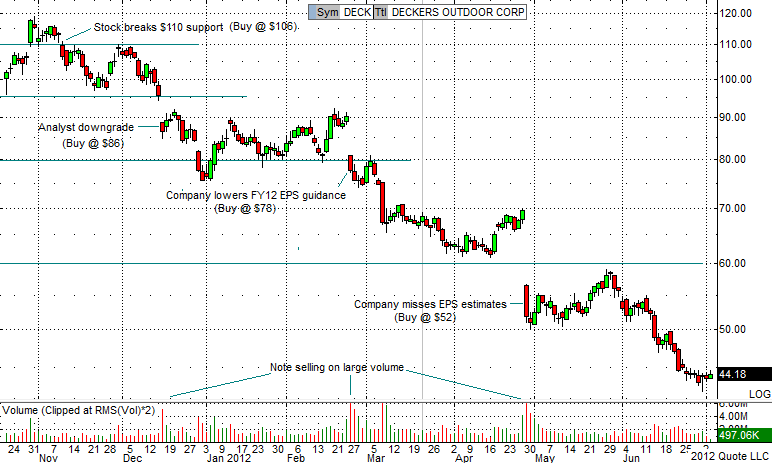

Why Averaging Down Is A Bad Investment Strategy Seeking Alpha

Average Down Calculator - Trade Optimizer Trading Calculator

Never Average Down You Make The Call Seeking Alpha

What Is Average Down - Fincash

E-manual Ipot

Modeling The Dangers Of Averaging Down Seeking Alpha

Average Down - What Does It Mean

The Risk Of Averaging Down Or Up On Trades On Strategy That Works

Stock Trading Strategy How To Average Down - Youtube

When Should You Average Down On Stocks Money Makers

Subject Choice According To The Current Stock Price Download Table

What Is The Best Strategy For Averaging A Stock Do You Need To Buy More When Your Stock Is Going Down Or Average Up When The Stock Is Going Up - Quora

Getting Started What Is Averaging Up And Averaging Down

What Is The Averaging Down Strategy Forex Academy

How To Average Down Stocks When Share Prices Are Falling European Dgi

Averaging Down A Trading Strategy To Avoid Or Embrace

The Risk Of Averaging Down Or Up On Trades On Strategy That Works

Never Throw More Cash To A Burning Houseon Averaging Down Pixiutrades

Getting Started What Is Averaging Up And Averaging Down - The Smart Investor

Comments

Post a Comment