To view detail information & trends click on individual category. Q / q revenue growth (q3 mrq) 2.66% :

Stag Industrial Stock Dividend Growth Ahead Nysestag Seeking Alpha

Common stock (stag) nasdaq listed.

Stag stock dividend growth rate. Over that period, the trust enhanced the total annual dividend payout amount 53%. Thereafter, the company expects its growth rate to be at a constant rate of 7 percent. Year 1 growth rate = n/a.

Now let us see the data for stag and edr. Y / y revenue change (mrq) to see industry, sector or s&p 500 performance, click on each category respectivly, on the top of the table. Y / y revenue growth (q3 mrq) 21.16% :

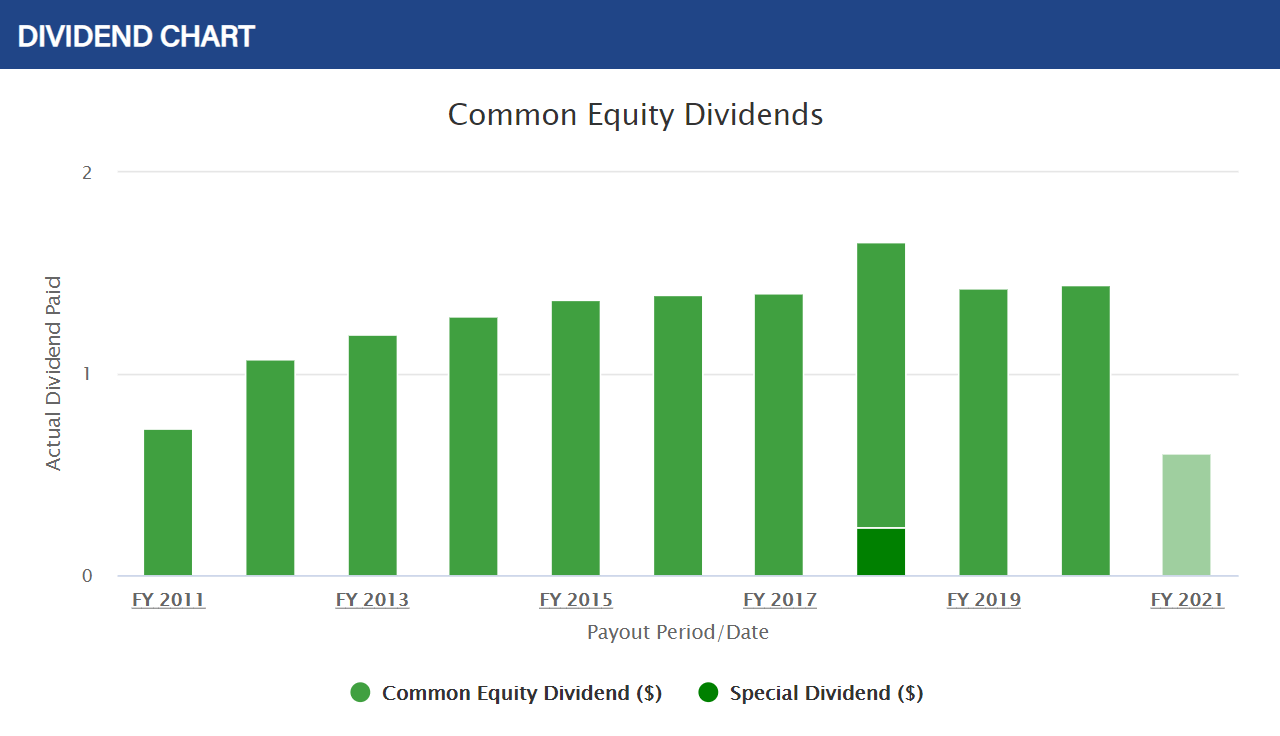

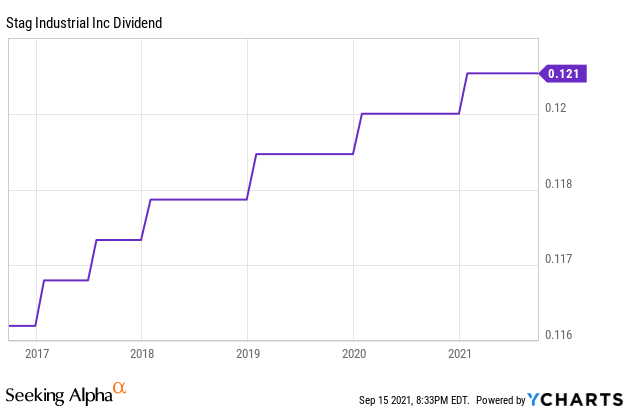

Since 2012, the company’s dividends have increased at an annual growth rate of 4.2%. A dividend raiser with room to grow. Will pay dividends of $4.75, $5.25, $5.75, and $7 for the next four years.

3, 5, 10 year growth rate (cagr) and dividend growth rate. We have determined the present value of the multiple growth stage to be pv = $14.01, shown here: (do not round intermediate calculations.

Stag has raised its dividend every year since it began paying one in 2011. 108 rows the dividend payout ratio for stag is: At the same time, the model implies a stock prices needs to grow at the same rate as the dividends do.

G = the constant dividend growth rate of the stock; The dividend growth rate (dgr) is the percentage growth rate of a company’s dividend dividend a dividend is a share of profits and retained earnings that a company pays out to its shareholders. In the above example, the growth rates are:

115.08% based on the trailing year of. This pace of advancement corresponds to an average growth rate of 5.5% per year. When a company generates a profit and accumulates retained earnings, those earnings can be either reinvested in the business or paid out to shareholders as a dividend.

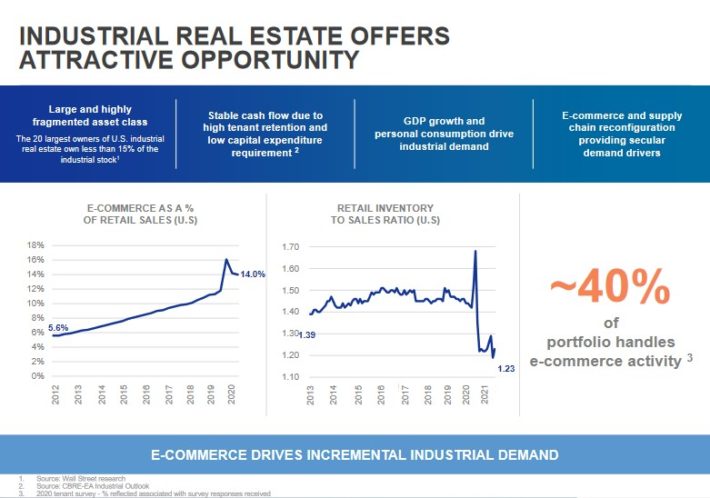

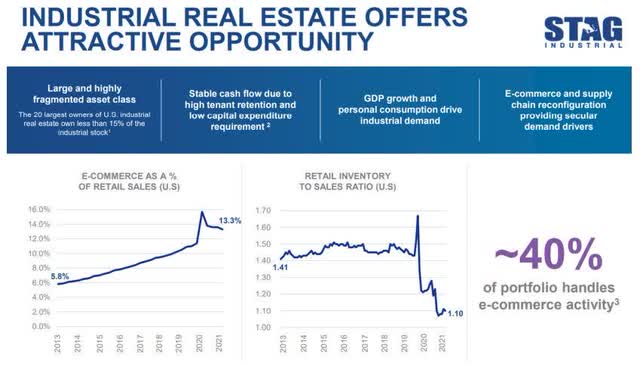

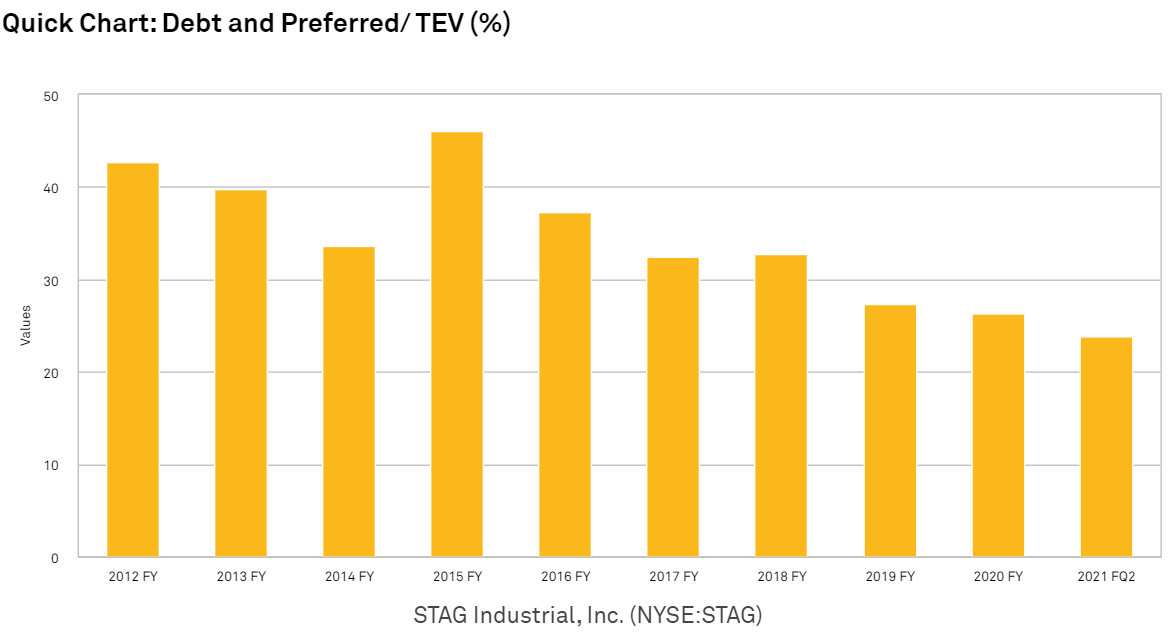

Data is currently not available. In this case, the 4% stable growth rate is the world bank’s long term global gdp growth rate. Stag has a diversified tenant base spread across many industries.

Stag revenue growth rate comparisons: For example, if you have a stock that pays a $1.45 dividend which is expected to grow at 15% for four years, then at a constant 6% into the future, the discount rate is 11%. Stag profile >> back to stag fundamentals >> compare stag efficiency to its competitors.

Stocks stag industrial, inc.(stag) and education realty trust inc.(edr) are similar in terms of market cap compared to stag industrial inc (stag) stock. 20 year annualized growth years of consecutive dividend growth 0.70% 2.49% 5.49% 0% 0% 9 Achieved during a certain period of time.

If the required rate of return is 15 percent, what is the current market price of the stock? Under the gordon model, a stock is considered by definition more valuable when its dividend increases, the investor’s rate of return decreases or when there is an increase in the expected dividend growth rate. You already know stag has paid 107 dividend payouts since jun 28, 2011.

Sample question compute the value of a share of common stock of a company whose most recent dividend was $2.50 and is expected to grow at 3 percent per year for the next 5 years, after which the dividend growth rate will increase to 6 percent per year indefinitely. 1 year growth rate (ttm). 110 rows the current dividend payout for stock stag industrial, inc.

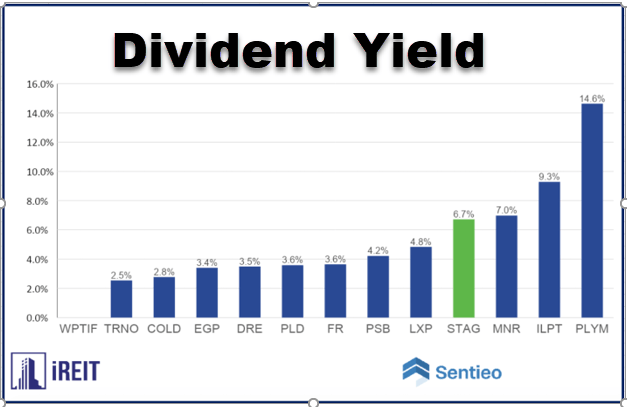

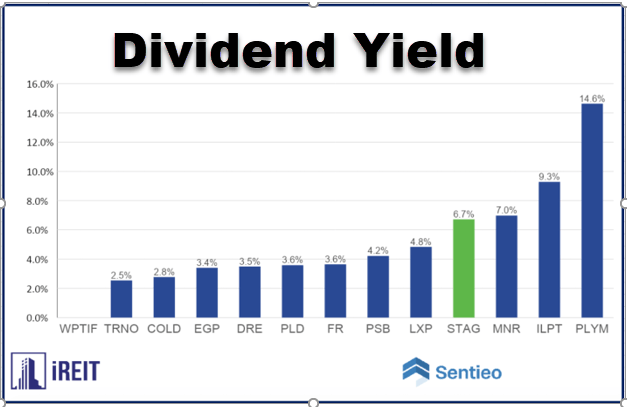

Stag industrial has offered its shareholders dividend hikes every year since the reit’s inception in 2011. Trading at $33.92 per share, stag industrial inc offers an annual dividend yield of 4.9%.

Stag Industrial Stag Monthly Dividend Safety Analysis

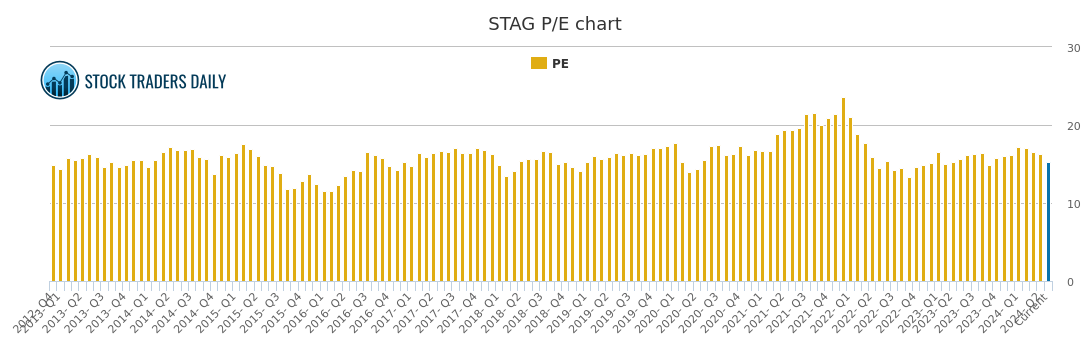

Stag Industrial Stag Pe Chart

Stag Industrial Stock Dividend Growth Ahead Nysestag Seeking Alpha

Prepare For Retirement With Stag Industrials 34 Dividend Yield Nysestag Seeking Alpha

Stag Industrial A Cash Flow Is King Pick Nysestag Seeking Alpha

Stag Industrial Inc A 38 Yielding Reit That Benefited From The Pandemic Nysestag Seeking Alpha

3 Stocks That Cut You A Check Each Month The Motley Fool

Stag Industrial A Monthly Dividend Machine At A Premium Price Nysestag Seeking Alpha

Stag Industrial Stock Dividend Growth Ahead Nysestag Seeking Alpha

Stag Industrial A Monthly Dividend Machine At A Premium Price Nysestag Seeking Alpha

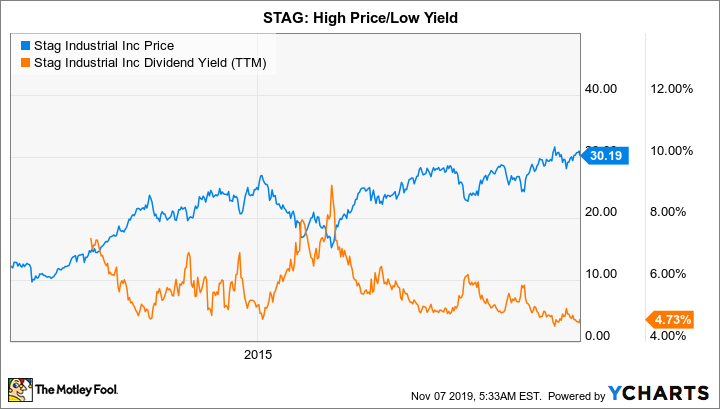

Is High-yield Stag Industrial A Buy The Motley Fool

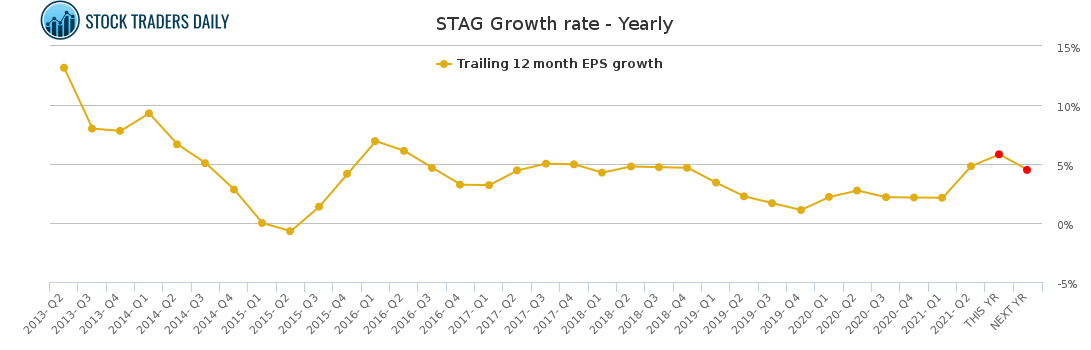

Stag Industrial Stag Growth Rate - Yearly

Pembina Pipeline A Top Ranked Safe Dividend Stock With 80 Yield Pba Nasdaq

Does Stag Industrial Inc Stag Pay Dividends

Stag Industrial A Monthly Dividend Machine At A Premium Price Nysestag Seeking Alpha

Does Stag Industrial Inc Stag Pay Dividends

3 Stocks That Cut You Checks Each Month The Motley Fool

Is High-yield Stag Industrial A Buy The Motley Fool

Stag Dividend Yield History Payout Ratio Stag Industrial

Comments

Post a Comment