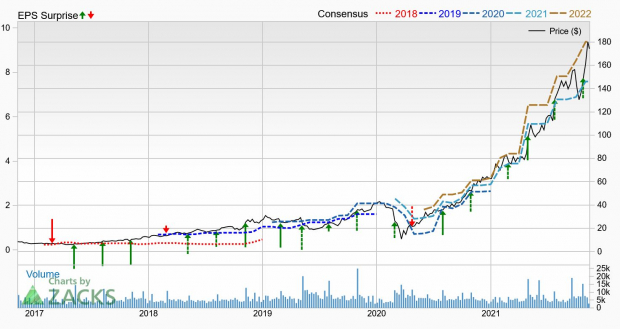

Synaptics (syna) delivered earnings and revenue surprises of 2.29% and 0.34%, respectively, for the quarter ended september 2021. The lowest sales estimate is $341.90 million and.

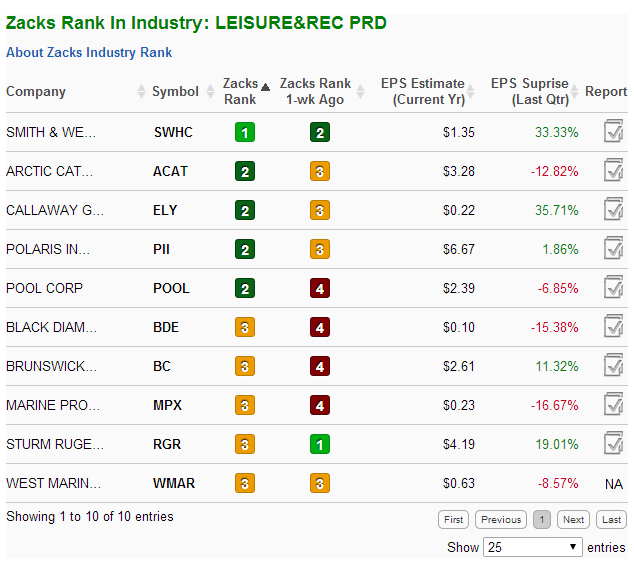

3 Growth Stocks With A Zacks Rank 1 - November 11 2021 - Zackscom

This suggests that the stock has a possible downside of 18.4%.

Syn stock forecast zacks. Given these factors, it shouldn't be surprising that syna is a #2 (buy) stock and boasts a momentum score of a. This compares to earnings of. Their forecasts range from $2.50 to $2.50.

Synthetic biologics last announced its quarterly. The analysts previously had rating of buy. Wall street brokerages expect synaptics incorporated (nasdaq:syna) to announce $379.50 million in sales for the current quarter, according to zacks.

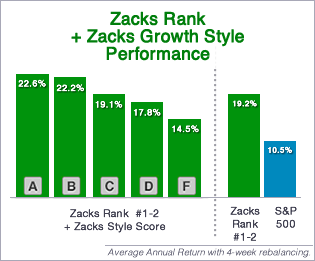

The zacks momentum style score encompasses many things, including estimate revisions and a stock's price movement. P/b ratios below 3 indicates that a company is reasonably valued with respect to its assets and liabilities. 114 rows syn earnings information.

Investors should note that earnings estimates are also. Price to book value per share ratio. See the report's 7 new picks today.

The p/b is a method of comparing a stock's market value to its book value, which is defined as total assets minus total liabilities. The zacks momentum style score encompasses many things, including estimate revisions and a stock's price movement. Right now, syna is averaging 419,825 shares for the last 20 days.

Their forecasts range from $175.00 to $310.00. Synaptics stock has undergone multiple analysts rating changes in the recent past. Both asx and syna are impressive stocks with solid earnings outlooks, but based on these valuation figures, we feel that asx is the superior value option.

On average, they expect synaptics' stock price to reach $233.33 in the next year. This suggests a possible upside of 536.3% from the stock's current price. Another notable valuation metric for simo is its p/b ratio of 3.43.

Synaptics (syna) appears an attractive pick given a noticeable improvement in the company's earnings outlook. Synnovia has a p/b ratio of 1.61. Shares of synaptics (syna) have been strong performers lately, with the stock up 52.5% over the past month.

By zacks equity research published on november 04,2021. Pag is currently sporting a zacks rank of #1 (strong buy), as well as a value grade of a. Synaptics (syna) could be a solid choice for investors given the company's remarkably improving earnings outlook.

On average, they expect synthetic biologics' share price to reach $2.50 in the next twelve months. Two analysts have issued estimates for synaptics' earnings. View synaptics incorporated syna investment & stock information.

While the stock has been a strong performer lately,. Investors should note that earnings estimates are also significant to the zacks rank, and a nice path here can be promising. The stock has been a strong.

We should also highlight that pag has a p/b ratio. In a note to investors, the firm issued a new rating of hold. One stock to keep an eye on is penske automotive (pag).

Each stock is a zacks rank #1 strong buy. Synaptics (syna) came out with quarterly earnings of $2.68 per share, beating the zacks consensus estimate of $2.62 per share.

Motley Fool Vs Zacks - Which Is Better Side By Side Comparison 2021

Will Barrick Gold Gold Beat Estimates Again In Its Next Earnings Report Nasdaq

Zacks Premium Review - Is The Paid Version Worth The Money

3 Growth Stocks With The Highest Zacks Rank

Snapshot Research Report For Aciu

Motley Fool Vs Zacks - Which Is Better Side By Side Comparison 2021

Zacks Investment Research Reviews - 97 Reviews Of Zackscom Sitejabber

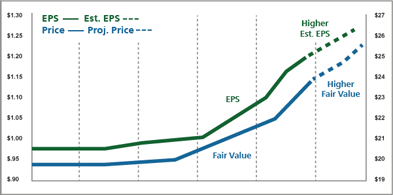

Style Score Education

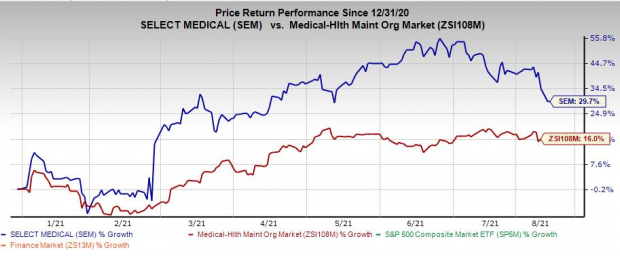

2 Highly-ranked Stocks To Buy In August And Hold Nasdaq

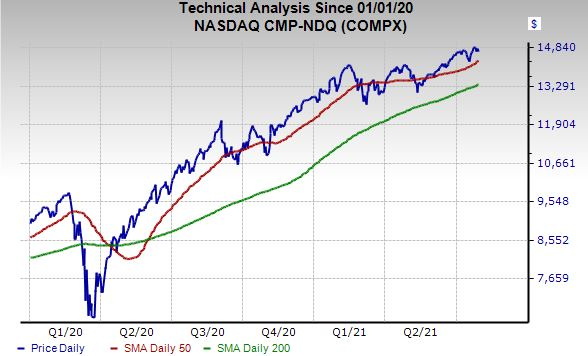

Industry Rank - Zacks Investment Research

7 Reasons Why Select Medical Sem Stock Looks Attractive - August 10 2021 - Zackscom

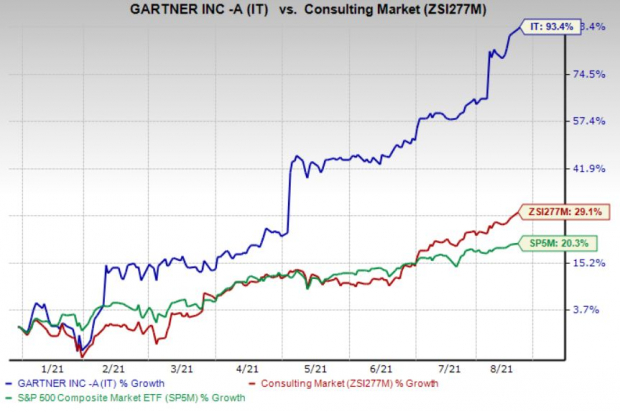

Gartner It Stock Rallies 934 Year To Date Heres Why Nasdaq

3 Growth Stocks With The Highest Zacks Rank

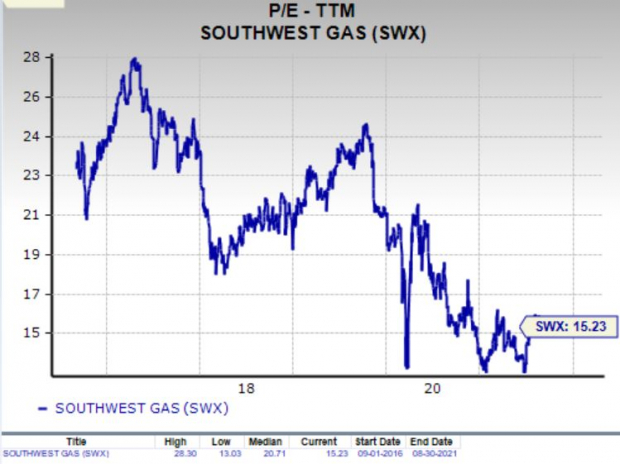

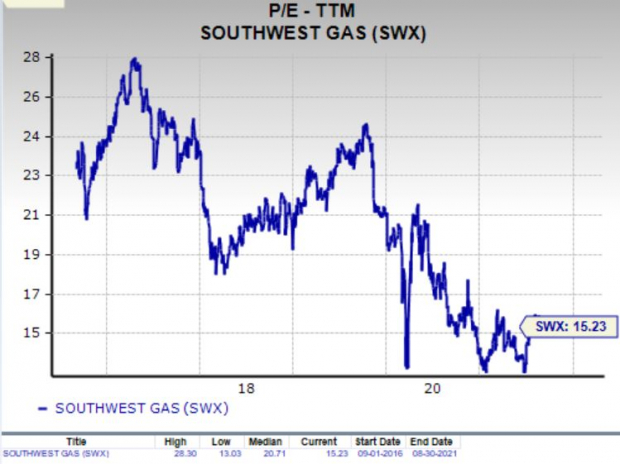

Can Value Investors Choose Southwest Gas Corporation Swx Stock Nasdaq

3 Growth Stocks With The Highest Zacks Rank

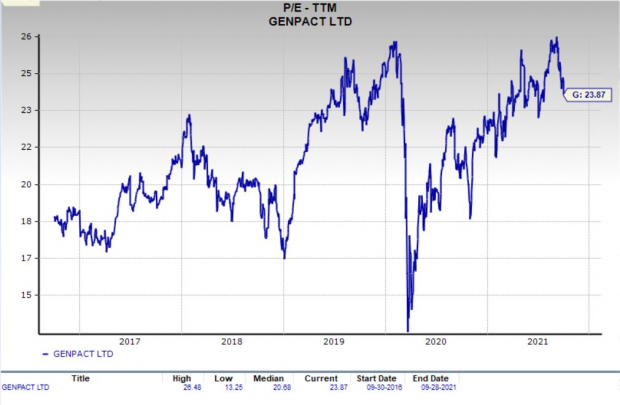

Should Value Investors Consider Genpact G Stock Now Nasdaq

Industry Rank - Zacks Investment Research

Stock Market Education - Zackscom

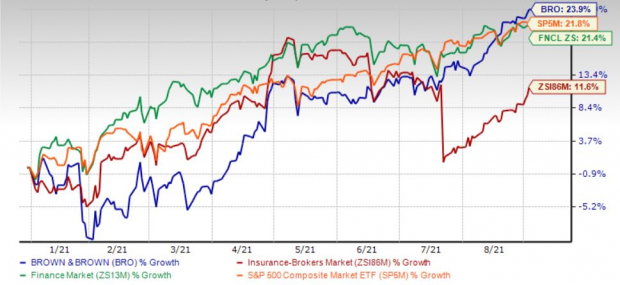

Brown And Brown Bro Stock Up 24 Ytd More Room For Upside Nasdaq

Comments

Post a Comment